Strategy Development – A Fundamental Part Of Business Success.

A Portfolio Review can be an excellent place to start a quality assurance program within an organisation. With a relatively small amount of information about your portfolio you can develop some quite sophisticated views of your activity and gain insight into both how well you are deciding which projects to do but also how well you are doing those projects.

The first part of a Portfolio review is to “muster” all the projects that are active and pending. Secondly basic information is gathered for each project:

1. Project Executive

2. Project Manager

3. Strategic contribution or Alignment to the Strategy if contribution is not calculated

4. Start date

5. End date

6. % complete

8. Cost (Budget, actual, cost to complete)

9. Risk (in particular estimate of probability of success)

10. Technology (“Existing” to “Radially New”) Customer Impact (“Me Too” to “Significant Benefit”)

11. Resources (If known Forward Resource Planning can be developed)

With this basic but limited information one can present quite sophisticated views of the portfolio:

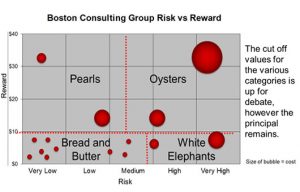

BCG, Risk vs Return vs Cost

The BCG identifies the high risk low value “White Elephants”, these projects should be up for immediate review. Organisations need to be aware of the resource sapping, low risk low value “Bread and Butter” projects. These projects are easy to justify initiating but can draw resource away from high value projects.

High value low risk “Pearl” projects are the no brainer opportunities, the challenge is in the validity of the assumptions and valuation of those projects. The challenge with the high risk high value “Oyster” projects is to reduce their risk and make them Pearls.

It should be noted that there is a general tendency to over estimate value and underestimate the probability of success.

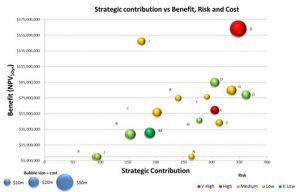

Strategic contribution vs Benefit, Risk and Cost:

Ideally an organisation will want to initiate projects that not only have the greatest value but also contribute the most to delivering to the strategy.

This view looks at strategic contribution, benefit, risk and cost.

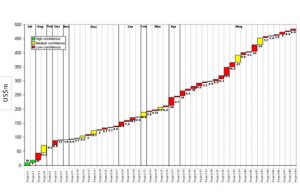

The Stairway to Heaven:

The “Stairway to Heaven” view highlights when your projects are supposed to deliver, their value and risk.

The challenge is not to have a “hockey stick” profile and to move the delivery of high value projects to the left, while questioning the value of continuing the projects that deliver little value.

Customer Technology Impact:

The “Customer Technology Impact” view can tell you about the balance of your new product portfolio and can lead to questioning the rationale of the portfolio.

Combinations of these views can tell a story of the performance of the portfolio as a whole.

Stakeholder Interviews:

Stakeholder interviews and surveys are also performed to evaluate the strategy development process and clarity of direction, the portfolio analysis and management processes that lead to project initiation and continuation of in-flight projects as well as project governance, management, monitoring and delivery.

Idea Partners can facilitate the portfolio review process and provide all the necessary supporting tools. Contact us for more information.